The market of the old to be renovated may also be a good investment and in this case two mechanisms are to be compared.

- The Malraux Law ;

- The taxation of Historic Monuments;

What type of building should it be?

In both cases it is about beautiful stones, i.e. an old building of character, dating from several centuries. The investment consists of transforming a former hospital or a private mansion into housing. This transformation had to be carried out “dans les règles de l’art” in order to preserve as much as possible of the character of the old building - high ceilings, large windows, fireplaces and mouldings. The work is extensive and of high quality: the entire building is being brought up to current standards (thermal, sound and acoustic insulation). This work cannot be done by just any company. Indeed, the Architectes des Bâtiments de France and those of the Monuments Historiques ensure that the rehabilitation is carried out with respect for the historical structure of the building. This expertise and know-how can be found among specialist craftsmen who are able to carry out "tailor-made" work. This is a substantial budget (+20-30%) but unavoidable if you want to combine the country's historical heritage with your income.

In both cases it is about beautiful stones, i.e. an old building of character, dating from several centuries. The investment consists of transforming a former hospital or a private mansion into housing. This transformation had to be carried out “dans les règles de l’art” in order to preserve as much as possible of the character of the old building - high ceilings, large windows, fireplaces and mouldings. The work is extensive and of high quality: the entire building is being brought up to current standards (thermal, sound and acoustic insulation). This work cannot be done by just any company. Indeed, the Architectes des Bâtiments de France and those of the Monuments Historiques ensure that the rehabilitation is carried out with respect for the historical structure of the building. This expertise and know-how can be found among specialist craftsmen who are able to carry out "tailor-made" work. This is a substantial budget (+20-30%) but unavoidable if you want to combine the country's historical heritage with your income.

Where should the property be located?

How is the price set?

Is it possible to rent out the property?

This obligation does not exist with Monuments Historiques but you have the choice of either living in the flat or renting it out for at least 3 years. An important constraint of the Monument Historique scheme - the mandatory minimum holding period of 15 years.

What is the taxation of each law?

- In Malraux it applies to the applicable income tax rates.

- In historic monuments it is based on the deduction of the taxable base which applies to the overall gross income.

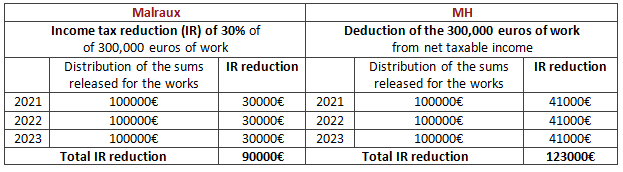

Here is a comparison of the two schemes in figures.

- An investor with a net taxable income of €300,000 3 parts (2 children)

- Marginal tax bracket (TMI) of 41%. Tax due: €91,000

- €300,000 of works

It is obvious that for the same investment, with the same amount of work, it is more interesting for this taxpayer to invest in MH earlier than in Malraux.

The Malraux scheme has another advantage - exemption from inheritance tax, but to benefit from it you have to sign an open-ended agreement with the Ministries of Culture and Budget. This document will specify the terms of maintenance of the property concerned, the conditions of access to the public, and the maintenance of the furniture in situ. If one of the conditions is not respected, the inheritance tax is reinstated.

We are at your disposal to accompany you in your investment project in a listed or registered property from the property search phase to the finalisation of the purchase deed. We will be at your side to make budgetary estimates so that you can benefit from all the advantages put in place by the French state. Contact us at consulting@rosemont.mc