Yacht brokers face significant AML risks due to the diverse nature of super-yacht charter clients, which range from HNWIs, family offices, corporations, intermediaries, PEPs, celebrities, and private wealth vehicles such as trusts or foundations. These client types often bring complexity, such as opaque ownership structures, third-party payments, potential PEP exposure, sanctions risks, and tax avoidance schemes, all of which heighten the possibility of money laundering or reputational damage. Common red flags include reluctance to disclose UBOs, vague explanations of funds, sudden offshore payments, inconsistent or forged documentation, unusual itineraries involving high-risk jurisdictions, and pressure to bypass due-diligence checks.

An uneven playing field for yachting industry compliance internationally

Yacht brokers occupy a complex and uneven position within international anti-money laundering (AML) frameworks. Under the EU’s 4th and 5th AML Directives (AMLD4/5), they are not explicitly listed as obliged entities. Instead, they are captured indirectly under the category of dealers in high-value goods, which requires compliance only when cash transactions of €10,000 or more are involved. As most yacht sales and charters are conducted through bank transfers, this structure has left a regulatory gap, with many transactions falling outside the EU’s mandatory AML perimeter. This has created significant divergence at national level: while some member states have adopted extensions that explicitly bring yacht brokerage into scope, others remain tied to the baseline cash-triggered obligations.

Yacht brokers as stakeholders

A recurring issue is the status of yacht brokers acting as stakeholders, holding client funds in escrow accounts during sales or charters. In most EU countries, this activity is not separately regulated unless the broker also falls within another obliged category, such as being licensed as a payment service provider or qualifying as a high-value goods dealer. Italy is the notable exception: Italian law interprets brokers who intermediate in yacht transactions—including when they receive or disburse client funds—as obliged professionals. Italian brokers must therefore conduct full customer due diligence (CDD), identify beneficial owners, and report suspicious transactions whenever they manage yacht sales, purchases, or charters, particularly above €10,000. By contrast, France includes brokers under its category of “commerçants de biens de grande valeur” (merchants of high-value goods), but obligations are tied mainly to cash transactions of €10,000 or more. Similarly, Cyprus and Greece adopt the EU directive’s standard approach: AML duties arise for brokers only in relation to qualifying large cash deals, although Greek law explicitly lists yacht trading businesses in its AML statute.

Different application of AML obligations for yacht brokers throughout the EU

Several jurisdictions have gone further than EU minimum standards by expanding AML obligations to non-cash yacht transactions. Malta introduced a blanket prohibition on cash payments of €10,000 or more for yacht sales or charters in 2021, effectively eliminating cash dealings in the sector. In parallel, Maltese law designates yacht traders as “subject persons” required to conduct due diligence and monitoring for all high-value yacht transactions, even when paid by bank transfer. Belgium has also tightened its framework: it prohibits cash payments above €3,000 for goods purchases and treats luxury asset dealers—including yacht sellers—as obliged entities. This means Belgian yacht brokers must apply AML checks for almost all significant sales, regardless of how payment is made. Italy, Malta, and Belgium therefore stand out as countries that impose comprehensive AML regimes on yacht brokerage, going beyond the directive’s limited focus on cash. Meanwhile, Germany maintains a stricter definition of “dealers in goods,” applying AML obligations only to cash transactions of €10,000 or more. A multimillion-euro yacht sale conducted via wire transfer in Germany would not trigger AML duties for the broker—though banks processing the payments would remain responsible for AML checks. Other EU states, including Spain, Portugal, and the Netherlands, follow the same narrow, cash-based triggers. In the Nordics, strict cash limits (e.g. Denmark’s DKK 50,000 ban on most business cash transactions) indirectly reduce laundering risks, but brokers themselves are not legally obliged unless they breach those limits.

Application of AML obligations for yacht brokers outside the EU

Outside the EU, approaches vary considerably. In the United States, yacht brokers are technically included in the statutory definition of “financial institution” under the Bank Secrecy Act, but FinCEN has indefinitely exempted vehicle and boat dealers from comprehensive AML program requirements. This means U.S. yacht brokers are not required to establish AML compliance programs, verify customers’ identities, or file suspicious activity reports in the way banks must. Their principal obligation is cash reporting: any broker that receives more than $10,000 in currency (including related payments) must file an IRS/FinCEN Form 8300 within 15 days. This requirement applies to cash, cashier’s checks, money orders, or traveler’s checks, but not to wire transfers. States may reinforce these rules: for example, Florida can criminally prosecute yacht brokers who fail to report such cash receipts. However, neither federal nor state law mandates a full AML program for yacht brokers; in practice, most compliance focus is on cash reporting and sanctions screening (OFAC).

The Isle of Man applies AML rules to yacht brokers only if they accept cash of €15,000 or more, classifying them as High Value Goods Dealers (HVGDs). Brokers must register with the Financial Services Authority and follow the AML/CFT Code if this threshold is met. Escrow services alone do not bring them into scope unless high-value cash is received. Switzerland applies a much higher threshold: AML obligations for brokers arise only if a transaction involves cash exceeding CHF 100,000. Even then, brokers must verify customer identity, identify beneficial owners, and report suspicious activity to MROS. Payments by bank transfer, however large, do not create AML duties for Swiss brokers. In contrast, Liechtenstein has adopted a much stricter model. Under its Due Diligence Act, brokers dealing professionally in yachts are always subject to AML regulation, regardless of whether payment is in cash or electronic form. They must conduct due diligence, verify sources of wealth, monitor transactions, and report suspicious activity to the FMA/FIU. This makes Liechtenstein one of the few jurisdictions that explicitly treats yacht brokers as fully regulated designated non-financial businesses (DNFBPs). Monaco has also updated its framework to cover yacht sales and rentals explicitly, following a national risk assessment that identified yachting as a key sectoral vulnerability.

Application of AML obligations for yacht brokers in Monaco

Monaco yacht brokers must comply with Monaco’s AML framework (Law 1.362 and AMSF guidance) and international sanctions obligations, applying a strict risk-based approach. This means adjusting due diligence according to the client’s profile and transaction risk: simplified checks for low-risk individuals, standard measures for typical corporate clients, and enhanced due diligence (including independent wealth verification and senior management approval) for high-risk cases such as PEPs or complex structures. Brokers must also conduct ongoing transaction monitoring, regular sanctions screening, maintain detailed records for at least five years, and promptly file suspicious transaction reports with AMSF when red flags arise. This approach balances Monaco’s regulatory expectations with the operational realities of the yacht brokerage industry, while safeguarding against money laundering, sanctions breaches, and reputational harm.

The regulatory trend is towards greater coverage and harmonization. The EU’s forthcoming AML Regulation (AMLR), agreed in 2024, will for the first time explicitly include traders in luxury goods—such as yachts, private jets, and high-end cars—as obliged entities. It will require customer due diligence and reporting for all major yacht transactions above defined thresholds (provisionally around €7.5 million), regardless of whether payment is cash or bank transfer. This reform closes the long-recognized gap in EU AML rules and will bring currently unregulated brokers into scope across all member states by 2025–26. It aligns the EU with stricter regimes already in place in Malta, Belgium, Liechtenstein, and Monaco, ensuring that yacht brokerage is subject to consistent AML obligations across the single market. France has already adopted legislation in 2025 along these lines (loi contre le narcotrafic), not only including brokers dealing with sales and purchase, but also charters. Implementing decrees are awaited.

Implications for the industry are significant. Yacht brokers operating in the EU must carefully track their host country’s current rules: in Italy, Malta, and Belgium, they should expect to apply AML controls to nearly all major sales; in Germany and France, AML checks are required mainly for cash deals above €10,000. Outside the EU, U.S. brokers must comply with cash reporting but not broader AML programs, while Swiss and Manx brokers only fall into scope for unusually large cash payments. Liechtenstein and Monaco already require full AML programs for yacht brokers irrespective of payment method. Given the regulatory direction, industry best practice is to implement voluntary AML measures ahead of legal mandates. This includes customer identification, beneficial ownership verification, and monitoring of all high-value transactions, whether or not cash is involved. Doing so not only mitigates legal and reputational risks but also positions brokers to comply seamlessly when the EU’s harmonized AMLR takes effect.

AML Coverage of Yacht Brokers – Key Jurisdictions -summary

| Jurisdiction | Threshold / Trigger | Scope of AML Obligations | Non-Cash Transactions Covered? | Notes |

| EU (AMLD4/5 baseline) | ≥ €10,000 cash (single or linked payments) | Yacht brokers treated as dealers in goods when accepting large cash. | ❌ No | Non-cash yacht sales generally outside scope unless national law extends. |

| Italy | ≥ €10,000 (any form of payment) | Brokers treated as professionals dealing in valuable assets; CDD and reporting required for sales, purchases, and charters. | ✅ Yes | Explicit national extension; escrow/stakeholder roles also captured. |

| France | ≥ €10,000 cash | Brokers included under merchants of high-value goods; CDD/reporting required for cash transactions. | ❌ No (but strong regulatory guidance) | Authorities issue typologies urging vigilance for non-cash luxury deals. |

| Malta | ≥ €10,000 (cash or non-cash) | Brokers banned from accepting €10k+ cash; AML duties apply to all yacht trades above €10k regardless of payment type. | ✅ Yes | Yacht brokers explicitly defined as “subject persons.” |

| Belgium | ≥ €3,000 cash; broader thresholds for luxury sales | Brokers treated as high-value goods dealers; obliged to apply AML to most significant yacht transactions. | ✅ Yes | In practice almost all yacht sales covered; very strict national regime. |

| Germany | ≥ €10,000 cash | Brokers covered as Güterhändler (dealers in goods) only for cash sales. | ❌ No | Non-cash sales outside AML scope; banks process KYC. |

| Spain / Portugal / Netherlands | ≥ €10,000 cash | Yacht brokers fall in scope only for large cash transactions. | ❌ No | No explicit extension to non-cash yacht deals. |

| Nordics (e.g., Denmark, Sweden, Finland) | Very low national cash limits (e.g., DKK 50,000 in Denmark) | AML duties apply only if limits breached. | ❌ No | Low use of cash reduces exposure; no specific yacht broker provisions. |

| Greece | ≥ €10,000 (primarily cash) | Law explicitly lists yacht trading businesses as obliged entities for high-value deals. | ❌ No | Escrow/stakeholder roles not separately regulated. |

| Liechtenstein | ≥ CHF 25,000 (all transactions) | Yacht brokers treated as DNFBPs under Due Diligence Act; CDD/reporting required regardless of payment method. | ✅ Yes | Full obligations apply even for non-cash deals. |

| Switzerland | ≥ CHF 100,000 cash | Brokers covered under AMLA only for large cash transactions. | ❌ No | Non-cash yacht sales not regulated unless bank involvement triggers checks. |

| Isle of Man | ≥ €15,000 cash | Yacht brokers classified as HVGDs if cash threshold met; must register and apply AML rules. | ❌ No | Escrow activity only triggers obligations if cash ≥ €15k. |

| United States (Federal) | ≥ $10,000 cash | Brokers must file Form 8300 for cash receipts; no ongoing AML program required. | ❌ No | FinCEN exempts yacht/vehicle dealers from AML programs. |

| United States (State e.g., Florida) | Mirrors federal ($10,000 cash) | Reinforces Form 8300 reporting; failure may be a felony. | ❌ No | States focus on enforcement of federal cash rules. |

| Monaco | No cash carve-out; all yacht sales and rentals covered | Yacht brokers explicitly added to obliged entities list after 2022 NRA. | ✅ Yes |

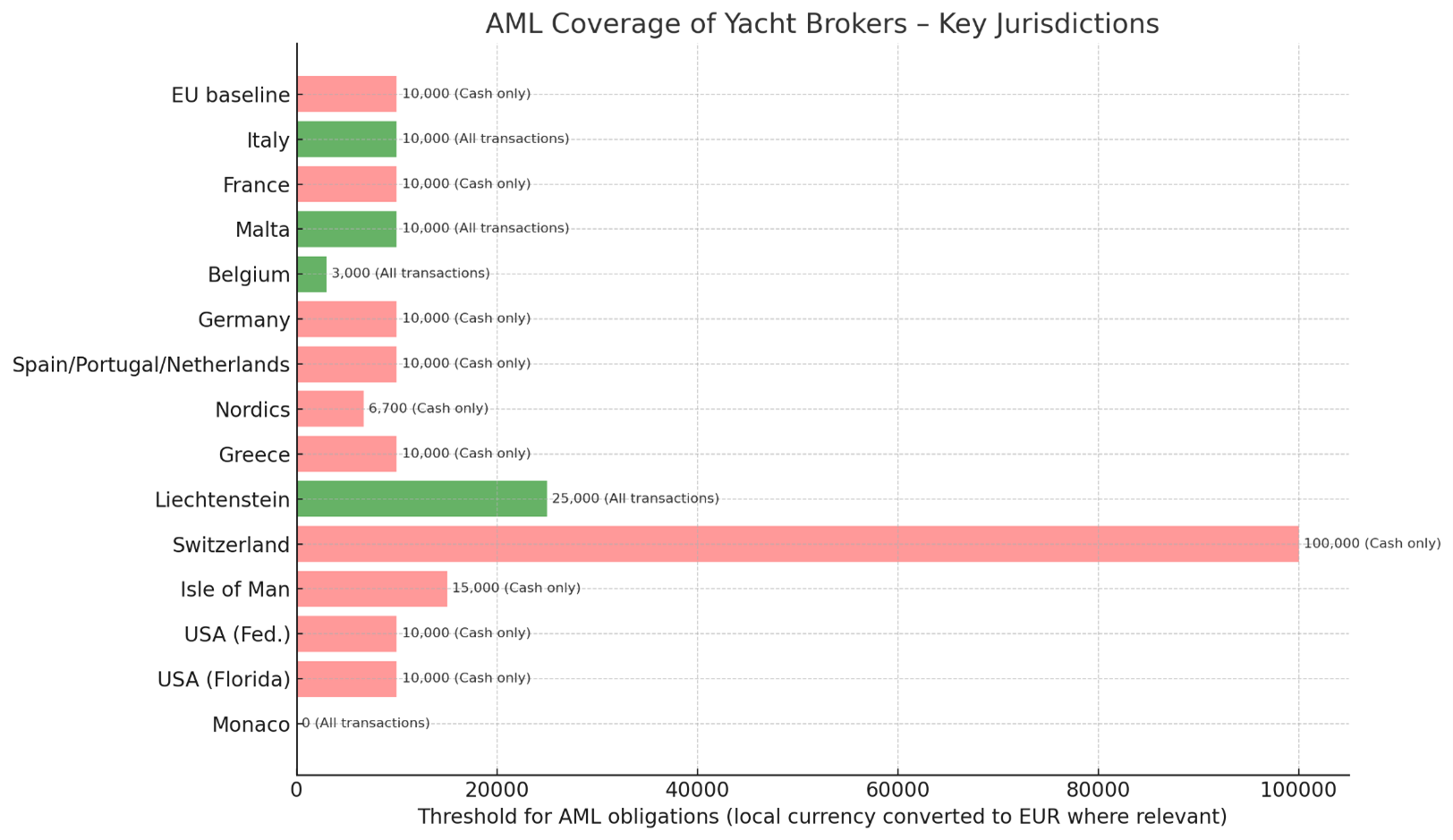

Chart comparing AML thresholds and scope for yacht brokers across the EU, US, and key offshore jurisdictions.

- Green bars = AML obligations apply to all transactions above threshold (e.g. Italy, Malta, Belgium, Liechtenstein, Monaco).

- Red bars = AML obligations apply only to cash transactions above threshold (e.g. France, Germany, Switzerland, USA).

Whilst we make an effort to provide accurate information in our articles the subject matters are complex, and are a condensed summary. This article does not purport to give legal advice. Information should be verified by local legal advice in each relevant jurisdiction taking into account each specific circumstance.

For further jurisdictional analysis please contact us: consutling@rosemont.mc

Follow us on LinkedIn and don't miss our updates about Monaco, Malta, Mauritius, and the yachting industry.